Make no mistake about it. What is taking place right now in Ukraine is extraordinarily serious. The IMF have recently agreed a support loan to the country, but the politicians themselves still can't agree on whether or not they are actually going to abide by the conditions attached to it. Meantime, as we can all see on our TV screens, tensions with Russia continue to escalate, fuelled by the conflict-ridden negotiations over Ukraine's gas debt.“In Ukraine, the evidence is still that policymakers do not quite understand the seriousness of the challenges they face,”. Timothy Ash, analyst at the Royal Bank of Scotland.

“There is a burgeoning economic crisis in the European periphery,” Krugman said on the ABC network Dec. 14. “The money has dried up. That’s the new center, the center of this crisis has moved from the U.S. housing market to the European periphery.”

And just to add to the nighmare, Ukrain's economy made a dramatic entry into recession in Q4 2008. In fact, so severe has been the slowdown that nobody at this point can even muster enthusiasm for opening up one of those interminable discussions about whether or not what the country is going through really counts as a "technical recession" (in terms of two successive quarters of GDP contraction) or not, since the drop in national output has been enormous, and it it fairly obvious that isn't about to come bouncing back up again. At least not for the next several quarters it isn't, and - to give us an early glimpse of the terrain onto which we are now entering - the World Bank have just forecast a 4% contraction in GDP for 2009.

In a year when you would think little would surprise us the sharp change in real Ukraine GDP dynamics has been astonsihingly swift, with the growth rate moving from the 11% year on year expansion registered in August to the 14% year on year contraction reported in November (according to data put together by the World Bank). GDP for the whole January-November period is now down to 3.6% when compared with the equivalent months in 2007, and this is reall a sharp drop, since the average over the first nine months of the year was a growth rate of 6.9%. For his part the office of Ukraine President Viktor Yushchenko is suggesting that gross domestic product may contract at an annual rate of between 7 percent and 10 percent in the first quarter of next year, and by 5 percent over the whole year, according to Oleksandr Shlapak, deputy chief of staff to the president.

The contraction has been led by sharp falls in manufacturing and construction, while the financial system has been in serious trouble since late September, and the loss of UAH deposits from the banking system has amounted to 14% during October and November. But the real problems Ukraine is facing in confronting this most serious economic crisis, lieas in the political sphere, and the complete lack of the kind of political consensus which is so necessary to see through the measures which can it to an end.

Political Chaos Adds To The Problems

Ukraine’s government - which is laways a chaotic process at the best of times - is once more having a serious identity crisis about who it is and what it wants to do, with one of the exectutive's two visible hydra's heads (Prime Minister Yulia Timoshenko) seeking to respond by manipulating the currency downwards, by boosting social expenditure to an extent which will push next year’s budget deficit up to 2.96 percent of gross domestic product (from an agreed 1.4%) and well beyond the IMF pact level, and by attempting to resolve the trade deficit problem by imposing an administrative tax on imports. The other head of the hydra (President Viktor Yushchenko) is busy opposing all these moves on the grounds that they may jeopardize the second tranche of a $16.4 billion loan from the International Monetary Fund, and obviously, were this to be the case, the country would basically find itself bankrupt, and at the mercy of whatever sentiments the global financial markets wish to express when it comes to Ukraine.

Of course regular readers of this blog will not be surprised to find that this politically split personality crisis goes right into the heart of the central bank (see my Monetary Chaos Breaks Out At the Ukraine Central Bank post) and no one will be really that surprised to find that the two key characters in this round of the saga are (yet one more time, read the linked post, its all explained there) National Bank of Ukraine Governor (and board chairman) Volodymyr Stelmakh’s and Petro Poroshenko head of the central bank council.

Well things are really hotting up at the moment, with Viktor Yushchenko this week threatening to fire some central bank employees (presumeably those who were not implementing the decision to allow the Hryvnia to float), while Yulia Timoshenko was busy demanding the dismissal of National Bank Volodymyr Stelmakh himself - presumeably because he was trying to stop further currency intervention. In an official statement the central bank council responded by accusing Timoshenko of stirring up “chaos” and undermining the nation’s banking system, while Timoshenko, for her part has now taken the matter to the Ukrainian parliament (the Verkhovna Rada - where she may well carry a majority) which will now hold a full debate the role of the central bank next week. It seems not to matter too much here that the bank council is simply trying trying to implement a set of policies which were agreed to (or everyone thought they were agreed to) as part of the IMF loan agreement.

“A hryvnia level above 9 per dollar is unacceptable, it threatens the economy and banking system,” Petro Poroshenko, the head of the central bank council said. “The situation with the hryvnia rate demands urgent measures.”

Volodymyr Stelmakh, Central Bank Governor, the Yulia Tymoshenko Bloc is proposing his immediate arrest.

(Interfax-Ukraine) - Yulia Tymoshenko Bloc has proposed that, based on results of a report by an ad hoc parliamentary commission scrutinizing the National Bank of Ukraine's activities, an address should be sent to the Prosecutor General's Office and that National Bank Chairman Volodymyr Stelmakh should be arrested. "I think that, based on the report's findings, there will surely be an address to the Prosecutor General's Office of Ukraine and other law enforcement agencies, which, by the way, are already conducting inquiries," Volodymyr Pylypenko of the Yulia Tymoshenko Bloc said in an interview with Interfax on Wednesday. "The best gift in this situation can only be an order on taking [National Bank of Ukraine Chairman Stelmakh] into custody for all wrongdoings the National Bank has committed in the past months," Pylypenko said.

President Yushchenko did express the hope last Tuesday that Ukraine's currency market might be moving rightside up, with the hryvnia trading at about 7.8-8.0 to the dollar and level of "stabilising" dollar purchases by the central bankdeclining, but Prime Minister Tymoshenko remained unconvinced that this was a desireable level, and demanded more concerted intervention to move the currency up to a much higher level - around the 6-6.5 to the $ mark. She gave Yushchenko a week-and-a-half apparently, since otherwise she stated the country would face increasing problems with inflation, and in the banking and other sectors. It is not clear (at least to me) why these problems (which are, and will continue to be, serious) should suddenly deteriorate within the time scale of ten days, but presumeably there was another, more political, message behind this choice of words.

Adding to the confusion, Ukraine's parliament, has decided to impose an additional 13% temporary duty on all imported goods - and this despite the fact that Ukraine only recently entered the WTO. A total of 269 MPs from the ruling coalition and the Communist Party voted for the relevant law which amended existing Ukranian lefislation - with, it was said, the aim of improving the state of Ukraine's balance of payments. "Duties have been increased on all imported goods, apart from a [so-called] 'critical' [list of goods]," the head of the parliament's committee for tax and customs policies, Serhiy Teriokhin, is quoted as saying.

"I'm alarmed by the report of my legal department on parliament's decision to impose an additional temporary duty on all imported goods. Parliament's decision puts Ukraine's presence in international programs in jeopardy," President Yushchenko said at a press conference yesterday. "Similar decisions by Russia and Europe might be made against us in three days,".

IMF Taking Large Political Risk

Last month, a point in time which now seems so distant it feels like eternity, Ukraine received approval for a two-year IMF loan intended to help support its banking system and cover the country’s widening current-account gap during what was always seen as being a difficult adjustment process. Under the terms of its agreement with the IMF, Ukraine is expected to have a balanced budget next year. If the Cabinet fails to meet the target, then the Fund may withhold the second tranche of the loan, according to press statements by Balazs Horvath, IMF representative in Kiev. Ukraine received the first installment of $4.5 billion last month, and is due to get the second tranche in February. Obviously the IMF is by now well accustomed to playing the part of the "bad boy" in this type of situation, but what if the country they are trying to deal with should simply "implode", right in its face, I'm not sure even the hardened hand of the IMF are ready for this. So let's just hope I'm exaggerating, and that it won't happen (fingers tightly crossed everyone, please).

Discrepant GDP Forecasts

So Ukraine faces a crisis on three fronts, financial, economic and political. On the real economy side, the Ukraine cabinet currently expects growth in the country’s economy to slow to 0.4 percent next year, compared with a final rate which turn out to be somewhere between 1.8 percent and 2.5 percent this year. As I say the World Bank now expects a 4% contraction in GDP next year, and thus a 0.4% expansion in the budget is potentially a very serious problem indeed for the deficit, if the economy underperforms, as it surely will.

“The draft budget, prepared by the Cabinet, is not realistic,” Yushchenko said today in a statement on his Web site. “The 2009 budget is a tragedy; it is the most irresponsible document worked out by the government. Professionals should plan a realistic budget, not optimistic.”The government plans to cover the budget deficit by selling bonds in domestic and foreign markets, and is to receive a $500 million loan from the World Bank to cover the budget deficit. Under the terms of the IMF agreement with the Inernational Monetary Fund Ukraine has pledged to keep its 2009 budget deficit under 1 percent of gross domestic product, below the 2 percent initially planned by the government. In October, the government reduced its planned 2008 budget revenue from the sale of state assets to 401 million hryvnia ($59.4 million) from 8.6 billion hryvnia, citing the unfavourability of the moment for selling.

Pressure On The Hryvnia

The Hyrvnia has been falling for a number of weeks, but the rate of decline has really accelerated in the last ten days, and we are really now talking about one of those famous currency crises. The national currency has fallen 50 percent against the dollar since June, and according to Michael Ganske, head of emerging markets in London for Commerzbank, it may well drop another 24 percent in the next few weeks given market sentiment and that the International Monetary Fund package effectively limits central bank intervention to halt the slide. The terms of the IMF $16.4 billion bailout package, agreed to last month, require Ukraine to move toward a flexible exchange rate and place a maximum limit of 4 percent for any reserves reduction during the remainder of 2008 (from the base of around $32.8 billion). Thus while the agreement does allow intervention to stem “disorderly” swings, it places a tight limit on what this means. And this now is just the problem, although before we jump to our guns, we should bear in mind that what is provoking the fall is not the IMF and the bailout, but confidence in the ability of the political system to implement a workable recovery plan. Trying to run a currency corridor, and accepting the inflation that went with it, is how we got here in the first place.

The only real remedy Ukraine’s central bank has at its disposal at this point is to raise its base refinancing rate, and this it duly did last week, taking it up from 18 percent to 22 percent in an attempt to arrest the hryvnia’s decline To give us some idea where we are at this point, at the start of 2008 the dollar bought 5.04 hryvnia, while right now it can purchase around 8.25 hryvnia.

The central bank is currently offering to sell dollars at 8.0 hryvnias and to buy them at 7.8788 on the interbank market. Yushchenko told a news conference last week that the central bank had bought $270 million on Monday and Tuesday, but had been required to sell only $30 million on Tuesday. He informed the assembled journalists, however, that complete stabilisation would need to wait until after the debts for Russian gas and other expenditures had been paid (you should be able to start to smell just how complicated all this is by this point, just who exactly is batting for who here?). "Until debts are paid for gas, and settling the debts of (the national road network) Ukravtodor, it would be madness to talk about steps aimed at a fundamental, professional stabilisation". "Everything is earmarked", he claimed, "$3 billion (for intervention from reserves), more than $2 billion set aside for gas arrears, $1 billion for repayment of a loan to Ukravtodorom, $200 million to (rocket maker) Yuzhmazh, leaves only an additional $400 million to defend the hryvnia."

As a result of the $7.5 billion the Ukraine central bank spent supporting the hryvnia in October and November foreign reserves fell to $32.7 billion as of Nov. 30. At the same time the hryvnia has declined 21 percent against the dollar over the last month alone . Under the terms of the agreement with the IMF, the reserves should not fall below $31.4 billion by the end of this year, so we are talking about a very close call on this front too.

Equities Down And Credit Default Swaps Up

Ukraine’s stocks have also been falling, and the benchmark PFTS stock index is down 74 percent this year, the third-steepest decline among the 22 so-called frontier markets tracked by MSCI Barra. Mariupolsky Metallurgical Plant, Ukraine’s largest steel company by revenue, has fallen 92 percent on the Kiev stock market. On the other hand the extra yield investors demand to own Ukrainian government bonds instead of U.S. Treasuries has increased more than nine times this year to 25.86 percentage points, according to JPMorgan Chase’s EMBI+ indexes, which compares with an average three-fold increase in the main emerging-market index to 7.09 percentage points.

Loan Defaults Coming

And as the currency slides, so too does the ability of the average Ukrainian to pay his or her debts. Another Yushchenko aide, Roman Zhukovskyi, recently estimated that up to 60 percent of foreign-currency loans and mortgages could default given the extent of the decline. Ukraine, which has around $105 billion in corporate and state debt, has the fourth-highest credit risk worldwide, according to credit-default swap data. The cost of insuring Ukraine bonds against default is up more than thirteenfold this year, to an astonishing 31 percent of the amount of debt protected. This puts the country behind only Ecuador, which defaulted last week (59 percent), Argentina, which defaulted on $95 billion in bonds in 2001 (46 percent), and Venezuala ( 33) percent, according to the data from CMA Datavision.

Ukrainian companies need to repay as much as $4.1 billion this month while lenders refuse to refinance debt, according to Dmitry Gourov, an economist at UniCredit in Vienna (oh, no, not Unicredit again, see this post). Dollar denominated loans made up 53 percent of credit issued by Ukrainian banks as of 30 September, according to central bank data.

Thus, with just over half of all bank loans denominated in US dollars, they obviously become vastly more expensive for borrowers who are paid in the national currency.

Aggressive lending by banks that borrowed heavily from abroad has obviously contributed to Ukraine’s ballooning private sector external debt (currently estimated at $85 billion). Official figures indicate that only some 2.5 percent of loans are currently problematic, but this situation is obviously about to worsen considerably next year as the currency is down and the economy contracting.

Earlier this month, Finance Minister Victor Pynzenyk called on banks to refinance loans amid a weakening hryvnia and rising interest rates. Some banks in recent days said they would seek compromises with clients, rather than hike interest rates further. Pynzenyk’s proposal called on the NBU to amend its rules to allow borrowers either partially or in whole to pay back loans in the national currency at the exchange rate which was operative when the loan agreement was signed. The banks, in turn, would be allowed to lower their capital/asset ratios and write off their losses, thus paying lower taxes, which would also require amendments to the tax legislation. Obviously some such solution will need to be found for this problem. (There has already been some move in this direction in Hungary, another of the countries which is strongly affected by the forex loans problem).

Other measures under consideration at the present time include extending loan periods, and the temporary reductions in loan payment installments. If the hryvnia-dollar exchange rate further widens, mass loan defaults are inevitable, according to Yuriy Belinsky, head analyst at Astrum Investment Management. At the current Hr 8 to the $1 rate, “40 percent won’t be able to pay their loans,” Belinsky told Korrespondent, a Russian-language Ukraine newspaper.

And the situation is deteriorating fast, a quick visit to the foreclosure sections on the websites of banks like Finance and Credit Bank or Alfa will turn up plenty of property and cars already listed for sale or soon to be auctioned. But given the slump in the real estate market and falling house prices it isn't clear that banks will find it any too easy unloading any property they do repossess. We are back to the "you owe them a little money and you have a problem, and you owe them a lot of money and they have a problem" situation. Last weekend, the NBU also recommended that banks lower interest rates on foreign-currency denominated loans, but the problem is going to be, as ever, who is actually going to fund these measures?

Industrial Output Plummets

Meantime in the world of the real economy things simply get worse and worse. Industrial production shrank by a record 28.6 percent in November as steel, machine building and oil refining slumped, after a 19.8 percent decline in October.

And as output falls, prices come tumbling behind. Steel production dropped 48.8 percent in November, while the price of the benckmark European hot rolled coil has fallen 47 percent since August and is now at around $425 a metric ton, according to data from U.K. industry publication Metal Bulletin.

World Bank Forecast

The World Bank have predicted a sharp recession for Ukraine in 2009, with GDP being expected to fall by some 4.0 percent. This compares with their July forecast of 4.5 percent growth. The Bank also cut back its forecast for 2008 growth to 2.3 percent from a previously forecast 6.0 percent. It raised its inflation forecast for this year to 22.8 percent from 21.5 percent previously predicted, up from 16.6 percent in 2007. It cut its forecast for inflation next year to 13.6 percent from 15.3 percent.

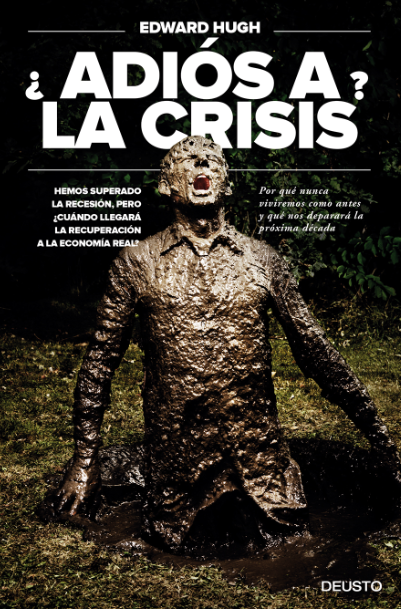

(please click on image for better viewing)

The Bank take the view that the Ukraine government - in agreeing to the terms of the IMF loan package - have initiated an important programme of macroeconomic adjustment measures, but (with a wary eye on what is actually going on in the Parliament) stress that consistent implementation is essential to avoid a further erosion of market confidence. In their latest report the Bank highlight the shift towards a flexible exchange rate policy, financial sector stabilisation measures , and a more conservative fiscal policy, but as we have seen, these are just the measures which seem to be being challenged by some of the political participants .

So What Does The Future Look Like?

Obviously Ukraine is heading into a major recession in 2009 fuelled by the nasty cocktail of a credit crunch, a terms of trade deterioration, and a consequent massive slowdown in both internal and export demand. Given the damage to competitiveness caused by two years of double digit inflation, macroeconomic stabilization will require a very large and significant correction, and this will mean a significant tightening of aggregate demand and a shift in its composition away from domestic consumption and towards net exports. The government debt stock is currently low at 10 percent of GDP, and will undoubtedly remain sustainable throughout and after the adjustment, even allowing for the potential costs of bank recapitalization. But the ability of the Ukraine administration to carry out the necessary adjustment hinges critically on the willingness of external creditors to refinance the banking and corporate sector debts, and this willingness in its turn depends on the perception those creditors have of the level of political coherence and stability the country has. And as we are seeing such perceptions must be reasonably near an all time low at the present time.

But even with the best political system in the world, the economic correction facing Ukraine is going to be large and the stresses enormous. The World Bank more or less spell this out in the paragraph I extract below. A 200% contraction in real imports (ie not due to cheaper energy prices or something) is massive, and we are talking about a basically balanced budget (ie very little fiscal stimulus) and monetary policy where interest rates are at the current giddy heights of 22%.

The basic macroeconomic parameters in our forecast are broadly consistent with those of the IMF program. Balance of payments pressures will lead the economy to adjust the composition of growth through 2009. As a result, the current account deficit is expected to improve from over 6 percent of GDP in 2008 to 1-2 percent of GDP in 2009-11. To achieve this adjustment, an over 20 percent real import contraction will be needed in 2009 in order to counter the 7 percent forecast terms of trade deterioration. Real wages and employment are forecast to decline in 2009 to restore price competitiveness of Ukrainian exports in the wake of declining export prices and to support the adjustment in aggregate demand. With this current account adjustment and with the support of the IMF Stand-By, the external financing gap would be closed under our baseline assumptions. Declining commodity prices, tightening liquidity and the forecast decline in domestic demand will contribute to disinflation. However, offsetting this, the exchange rate correction and the adjustment of energy and utilities tariffs will make disinflation a more prolonged process. We assume that the government will maintain a balanced budget in 2009 (not accounting for bank recapitalization costs) and have a small deficit thereafter.

So I think we need to be very clear at this point. The Ukraine position is very difficult, and everything is very delicate. The danger of total financial meltdown (which would be in this case in the private banking sector, not sovereign debt) is real and significant. The economic downturn has only just started and further downside risks are large and depend critically on the size of external shocks and the limitations imposed by inadequate policy responses.

Any further deterioration in the terms of trade (unlikely at this point given how far steel prices have already fallen, but these prices may stay lower for longer than many in the sector can sustain) or further decline in export demand would certainly put almost unsustainable pressure on the real sector. Banking sector vulnerabilities may be further exacerbated by further overshooting of the exchange rate and external debt refinancing difficulties as corporate balance sheets weaken further and household incomes come under strain from rising debt service costs.

Prudent fiscal, monetary, and financial policies (many of them anchored in the program supported by the IMF), accompanied with renewed efforts to deepen structural reforms, can help Ukraine to stabilize its situation and move the economy towards recovery. Conversely, a continuation of the current disorderly response and poor implementation of the agrred policies may easily trigger further financial chaos leading to an even shaper downturn and a postponement of any recovery off into the distant sunset.

But Beyond The Recovery, What About The Demography?

One of the reasons why I think the IMF and the World Bank are taking such a big risk with their credibility in Eastern Europe at the moment, is that I don't think they are getting through to the heart of the problem. One way of thinking about this is to take Paul Krugman's favourite Keynes quote - "we've got magneto trouble" - and ask ourselves whether all we have before us in the CEE countires right now are magneto problems, or whether, to continue with the metaphor, we may not have issues with the cylinder head gasket. And it gets worse, because the cylinder head gasket does seem to have blown (and it will keep blowing) because we have leakage problems in the sump, and the main oil pump isn't working - and who knows, maybe the crankshaft even needs replacing. As they always tell you when you take the car into a garage for "fixing", we won't know till we take the thing apart. What do I mean?

Well take a look at the chart showing the relative size of annual births and deaths in Ukraine over the last twenty years.

I mean to the normal and untrained eye stands the problem stands out a mile, population dynamics went underwater in the Ukraine in the early 1990s, and they aren't coming back to the surface again (not now, not in thirty years, not...... well maybe never is too much of a long time, but certainly not over a time horizon which is going to make any essential difference to anyone who is already alive today.)

And this is without taking any outward labour migration into account, so just think about the negative labour market dynamics that this implies, and already has implied. Can anyone really be surprised that Ukraine has been suffering from acute inflation as its number one problem?

To some extent it is worth stressing here that what really matters is the actual numbers of annual live births, rather than any more complex measure of fertility. In 1989 for example there were nearly 700,000 children born in Ukraine. By 1998 this number was near to 400,000 (ie there was a drop of 40% or so in a decade). In practical terms (and if we take 18 as an average age for labour market entry in a country like Ukraine) next year there are potentially 650,000 people to enter the labour force, but by 2016 this number will be only 400,000. So it isn't simply a question of pushing the fertility rate up towards the replacement rate (a difficult, but not impossible task), we also need to think about what economists term the "base effect" here, that is that with each passing year and cohort you have less and less women in the childbearing ages, so even if those women replace themselves, the base of the pyramid is still much narrower than the top, and it is the people at the top who need caring for and financing.

And even if some of this loss can be offset at the workforce level by increasing labour force participation at the older ages, we would still be talking about a very sharp rise in the average age of the workforce. And productivity improvement alone cannot possibly hope to compensate for the kind of labour force contraction we should reasonably expect, at least not over such a short period of time it can't. So this is just one more reason why, against all expectation, fertility really does matter.

While many continue to believe that falling populations don't actually have any tangible impact on economic performance, it is very striking to notice that when it comes to ageing and declining populations we really lack ANY evidence to substantiate that claim in the affirmative. On the other hand we do have plenty of evidence from countries where the population is either falling or gathering negative momentum to suggest that these countries face some very special kinds of economic problems. The example of Eastern Europe is clear enough I would have thought, but people really do need to take a closer look at what has been happening in recent years in countries like Japan, Germany, Italy and Portugal. And if falling population does produce its own kind of economic problems, well then we should be expecting to see plenty of them in Ukraine, since as we can see in the chart below Ukraine's population peaked in 1993, and has been in some sort of free-fall ever since.

Evidently there are a number of factors which lie behind this dramatic decline in the Ukrainian population, fertility is just one of these (with poor health and net emigration being the others). Ukraine fertility is currently in the 1.1 to 1.2 Tfr range, and, as we can see in the chart below, it actually dropped below the 2.1 replacement level back in the 1980s.

Another major influence on demographic dynamics is health, and one good measure of this is the level of life expectancy, which in the Ukraine case has shown a most preoccupying evolution, since it has been falling rather than rising. The chart below shows life expectancy at birth for both men and women, the male life expectancy is evidently significantly below the combined figure.

This life expectancy situation is, as well as being preoccupying, highly unusual (it is however paralleled to some extent in Russia itself, and some other CIS countries). Apart from the obvious, the deteriorating health outlook which this data reflect places considerable constraints on the ability of a society like Ukraine to increase labour force participation rates in the older age groups, and this is a big problem since this is normally though to be one of the princple ways of compensating for a shortage of people in the younger age groups.

So what about the future? Well, two issues are really starting to worry me at present, the first of these is the short term fertility shock Ukraine will undoubtedly receive on the back of the current crisis. If young people were already rather reluctant to have children, then then will now almost certainly be much more so, given the downward pressure on living standards we are about to see.

The second worry concerns the future of the country itself. A recent study carried out jointly by the Kiev based Democratic Initiatives Foundation and Nova Doba History and Social Sciences Teachers Association found that while more than 93 percent of the Ukrainian seventeen year olds they inteviewed considered themselves Ukraine citizens, only 45 percent said they planned to live and work only in Ukraine, citing Western Europe, Russia and the United States as possible future destinations. When 55% of your potential future labour force are thinking of working elsewhere you have a problem, and one which needs a solution. Simply putting a strip of band-aid over a festering wound won't work, I'm afraid, however much the Ukrainian people may struggle and sacrifice. With or without Keynes, we've got more than magneto problems on our hands here.

Postcript

A much fuller analysis of the problems presented by Ukraine's long term population implosion (including the issue of out-migration patterns and trends) can be found in this post here.